The Ultimate Guide to New Jersey Renters Insurance

23 Apr 2024 • 5 min read

Renters insurance is an affordable and surprisingly easy way to safeguard your belongings and give yourself peace of mind. Whether you're renting in bustling Newark or enjoying the quieter life down the shore, don't let the high cost of living in New Jersey leave you without protection.

Unlike many insurance companies, Goodcover values both time and money. We're dedicated to making insurance fair for renters. Here's what you need to know about getting protected in The Garden State:

Why Do I Need Renters Insurance in New Jersey?

- Your stuff matters: Consider what it would cost to replace your clothes, electronics, furniture, and valuables if something unexpected happened – a theft, a burst pipe, or an accidental fire. Renters insurance covers those costs.

- Accidents happen – anywhere: If someone gets hurt in your rental unit, liability coverage in your renters policy can help protect you from lawsuits and medical expenses.

- Don't rely on your landlord. Their insurance covers the building itself, but your personal belongings are your responsibility.

How Much Is Renters Insurance in New Jersey?

Prices vary, but the good news is renters insurance in New Jersey is surprisingly affordable!

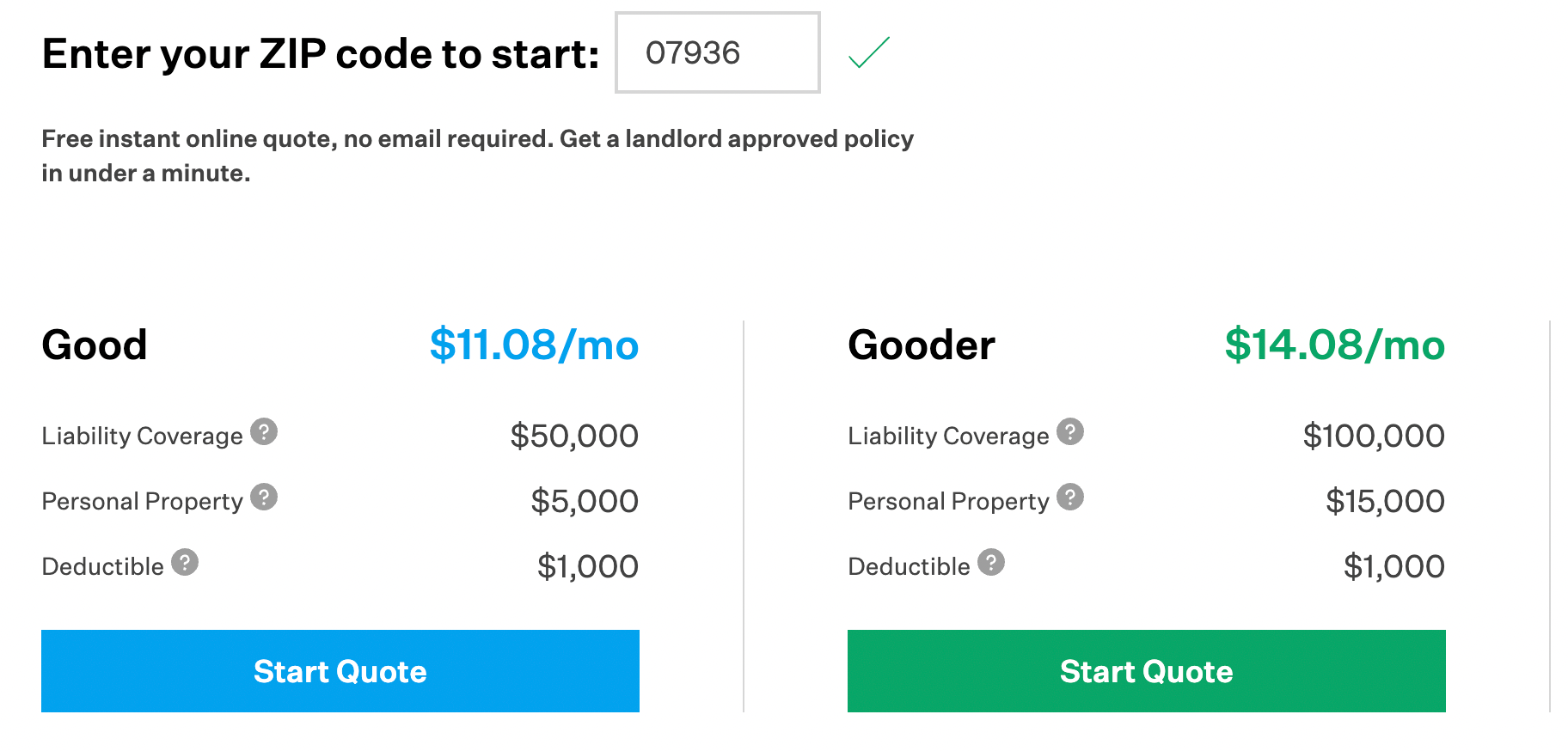

According to ValuePenguin, New Jersey residents pay about 13% less than the national average and the average cost of renters insurance is around $15/month, or $184 per year.

Goodcover, with our commitment to fair finance, is often even better than this average. Our typical policy costs around $12.83/month ($169 annually), and some policies are as low as $11/month.

What Does Renters Insurance Typically Cover?

Most renters insurance policies include:

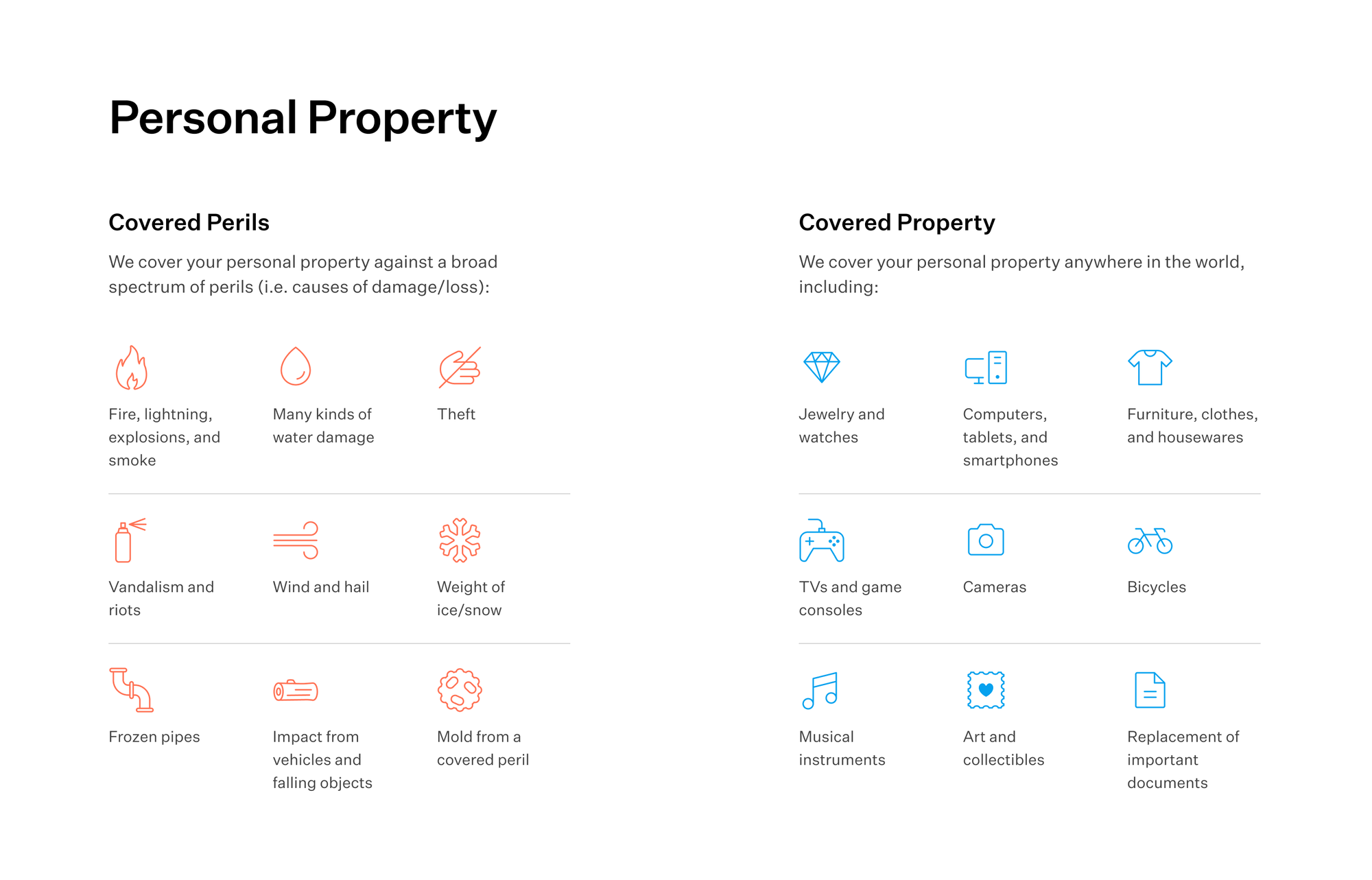

- Personal Property: Protection for your belongings if they are damaged or stolen due to a covered loss like fire, theft, vandalism, certain types of water damage, and more.

- Loss of Use: If your home becomes uninhabitable due to a covered event, this coverage helps with temporary housing costs and additional living expenses.

- Liability Protection: Helps cover costs if you're found legally responsible for injuries or property damage to someone else.

What's Typically NOT Covered:

Standard renters insurance policies usually exclude:

- Floods: Flood insurance is a separate policy.

- Earthquakes: You will need separate earthquake coverage for that.

- Intentional damage: Damage you cause on purpose isn't covered.

- High-value items: Jewelry, cameras, and musical instruments often have limits on standard coverage. If you have expensive items like these, consider adding Goodcover’s additional extended coverage, SUPERGOOD.

Your Goodcover renters insurance policy has seven exclusions altogether, so make sure you know what they are.

Understanding Deductibles & Coverage Limits:

When choosing a renters insurance policy, it's important to understand how deductibles and coverage limits work. These factors impact both your monthly premium and the amount of protection you'll receive if you experience a covered loss.

- Deductible: This is the amount you pay out of pocket before insurance coverage kicks in for a renters insurance claim. Choosing a higher deductible can lower your monthly premiums.

- Coverage Limits: These are the maximum amounts your insurance policy will pay out for specific types of losses. Make sure you choose limits that comfortably cover the value of your belongings.

How to Get the Right Renters Insurance in NJ

Getting the right renters insurance for your needs shouldn’t be stressful. Here’s how to approach it:

- Start with an estimate of value: If you don’t have time for a full home inventory right now, consider the general value of your personal belongings in each room so you’ll have a rough idea of what it would cost to replace items. This helps you get a quick quote and estimate your annual cost.

- Create an inventory for accuracy: When you’re ready, snap photos and create a detailed home inventory of your belongings with their estimated values. Many people do this during move-in/move-out since they already go through their belongings to sort and pack them.

- Get a quote: Goodcover's got you on this one! We provide free quotes faster than listening to your favorite song, and you can bind your policy from the comfort of your couch.

Goodcover: Making Renters Insurance Easier

We believe insurance should be hassle-free and fair for everyone. Here's why Goodcover is different:

- Lightning-Fast Quotes: Get a personalized quote tailored to New Jersey in under 90 seconds.

- Effortless Online Management: Manage your policy, make payments, and file claims conveniently online.

- Humans when you need us: You can handle everything online or reach our team anytime with any questions.

- Fairness-focused: We believe finance should be fair – especially for renters, who are often overlooked and overcharged by the insurance industry. We stand for affordable, transparent insurance for everyone in New Jersey.

Busting Common Renters Insurance Myths

Don't let these mistaken beliefs leave you uninsured. Here's why some of the most common renters insurance myths are not true:

- Myth #1: "It's too expensive." Not as much as you think! Goodcover’s policies in New Jersey start at $11/month.

- Myth #2: "I don't have enough stuff to warrant a policy." You might be surprised—possessions add up! Even a bed, a laptop, and a week’s worth of clothes add up quickly if you suddenly need to replace them.

- Myth #3: "My landlord's insurance covers me." Nope! That's for the building itself. You need insurance to protect yourself and your personal belongings. Plus, if you cause damage to the building, you’ll be held liable for it — and renters insurance covers liability, too.

Conclusion: Protection is Worth It

Get the protection you deserve at a price you'll love! With Goodcover, you can get your free personalized New Jersey renters insurance quote in under two minutes.

FAQs

- Is renters insurance required in NJ? Not by law, but your landlord may require it.

- What does NJ renters insurance not cover? Standard policies exclude earthquakes and floods. Ask about additional coverage for special risks and read our full exclusion list.

- How much does renters insurance cost in NJ? Prices vary by your stuff and location. Get a quick quote for an accurate idea.

- Does Goodcover renters insurance cover my roommates? If your roommate is listed on your lease, your Goodcover policy will automatically cover their belongings and potential liability, just as yours. If they aren’t on the lease, they should get their own policy.

Note: This post is meant for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Dan Di Spaltro • 3 Jul 2025 • 12 min read

Renters Insurance in Louisiana: A Complete Guide

Dan Di Spaltro • 2 Jul 2025 • 16 min read

Affordable Renters Insurance in Sacramento, CA

Dan Di Spaltro • 1 Jul 2025 • 14 min read

Renter's Insurance Boston: A Comprehensive Guide

Dan Di Spaltro • 27 Jun 2025 • 20 min read

Renters Insurance in Rhode Island: Costs & Coverage

Dan Di Spaltro • 26 Jun 2025 • 12 min read