From theft in Manhattan's busy streets to water damage in Brooklyn's older brownstones, renting in New York comes with its own unique set of challenges. Renters insurance is a powerful tool, providing a safety net for your personal belongings as well as peace of mind. By learning about common claims and how renters insurance helps with those claims, you'll take control of your financial security and enjoy New York living with confidence, knowing you're prepared for the unexpected. Let's jump in!

Common Renters Insurance Claims in New York

1. Fire and Smoke Damage

Fire is a serious concern for renters everywhere, but in New York City, the risk is heightened. With its mix of historic structures, high-rise apartments, and densely packed neighborhoods, the city presents unique fire hazards. Renters insurance offers important protection in the event of fire and smoke damage. Here's what it typically covers:

- Personal Property: Replacement cost for your belongings that are damaged or destroyed by fire or smoke. This includes furniture, electronics, clothing – all your personal property.

- Temporary Housing Coverage (aka Additional Living Expenses or Loss of Use): If your home becomes uninhabitable due to fire damage, your policy may cover the cost of temporary housing, meals, and other additional living expenses while your rental is being repaired.

- Liability Protection: If you're found responsible for a fire that damages your neighbors' property, liability coverage in your renters insurance policy can help cover their losses.

While renters insurance offers protection from fires, taking steps to prevent fire in the first place is even more important. Ensure your smoke detectors work, keep a fire extinguisher or fire blanket in your home, never leave your oven unattended, and don't overload electrical outlets – stay vigilant!

2. Theft and Burglary

Urban environments are often hotspots for theft and burglary, and New York is no exception – for example, New York City saw 1,328 burglaries in January 2024 alone. But whether you live in a small town upstate or busy Brooklyn, theft can happen anywhere. Renters insurance fully covers theft of personal property inside your rented residence and typically covers up to 10% of your property's value outside the home. So, if your belongings are stolen from your car, while traveling, or even from a friend's house, you're protected at replacement cost, not the depreciated value of your stuff.

Whether it’s electronics, jewelry, or other valuables, understanding the limits and exclusions of your policy is important. Review your policy documents to fully understand coverage limits and payouts. If you're not sure about something, Goodcover is available by phone, text, or email to answer questions.

3. Water Damage

Water damage is another frequent issue in New York. This can come from flooding, leaks, or even a neighbor’s plumbing mishaps. Coverage for water damage can be tricky; while Goodcover renters insurance offers valuable protection for many water-related incidents, understanding what is and isn't covered is key.

Goodcover renters insurance usually covers your belongings in the case of an overflow of water that you didn't cause. This includes events like a burst pipe, or if a heavy object falls and damages your plumbing, leading to water damage.

You may also add sewer backup coverage to protect you in case you suffer any personal property damage resulting from a blockage in the sewer systems, septic tank, or drainage systems.

Renters insurance doesn't cover gradual leaks, and it doesn't cover floods. For flood protection, you need a separate policy through the National Flood Insurance Program.

4. Personal Injury Claims

Accidents happen, and unfortunately, sometimes they happen at your home. Whether it's a guest tripping on a rug or slipping on your doorstep, you could be held liable for injuries if the accident occurs in your home. That's where liability protection in your renters insurance policy comes in handy.

Here's how renters insurance helps with liability claims:

- Medical Expenses: If someone is injured in your rental, your policy can help cover their medical bills, regardless of who is at fault. This can include expenses like ambulance rides, hospital stays, doctor visits, and medications.

- Legal Costs: If the injured party decides to sue you, your renters insurance can help cover your legal defense costs, including attorney fees and court costs.

In a place like New York, this coverage is invaluable. Even a minor accident can lead to a lawsuit, which can quickly become financially unbearable. Get the extra piece of mind from renters insurance, and protect yourself from unexpected costs resulting from an injury claim.

Checking Your Coverage

To ensure that you are adequately covered, it’s important to understand the specifics of your renters insurance policy. Here’s how you can check and verify your coverage:

1. Review Your Policy Declarations Page

The declarations page of your insurance policy is a summary of all the coverage you have. It includes the limits of coverage, your deductible, and any exclusions. Review this page carefully to understand what is covered and to what extent. If anything is unclear, contact us – we're here to help.

2. Understand the Limits and Sublimits

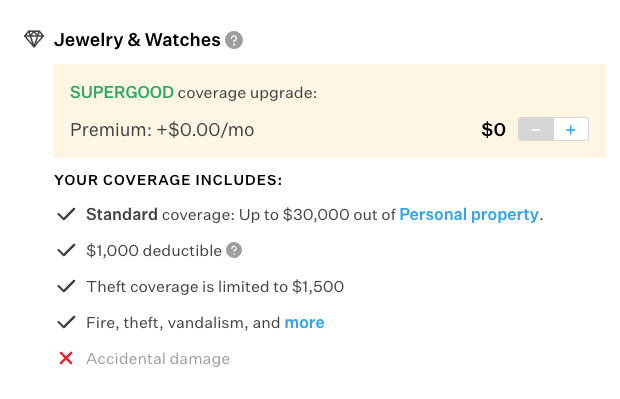

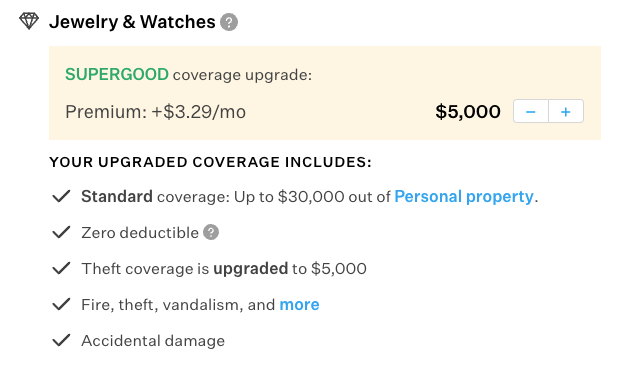

Your policy will have an overall limit, which is the maximum amount the insurance company will pay out for a claim. There are also sublimits for specific types of property or scenarios. For example, there might be a $1,500 limit on jewelry theft.

If your valuables exceed these sublimits, consider purchasing Goodcover's additional coverage in select categories, called SUPERGOOD, for a few dollars more per month.

3. Update Your Inventory List

Keeping an up-to-date home inventory of your possessions not only helps in assessing the adequacy of your coverage but also in the event of a claim. Document the make, model, purchase date, and estimated value of items. Taking photos and storing receipts digitally can also streamline the claims process. There are even home inventory apps.

4. Regularly Review and Adjust Your Policy

As your living situation and personal property change, so should your insurance. Under normal circumstances, aim to review your renters insurance plan at least once a year, right before your current plan expires. You can account for any changes in the value of your personal property and adjust your plan upwards or downwards.

You should also review your coverage after major life events. For instance, if you move, change jobs, or get married or divorced, you may have to adjust your renters coverage.

Final Thoughts

Renters insurance is a key component of living securely in New York. By understanding the common claims and how to check for coverage, you can protect yourself from potential financial distress. Being proactive about your insurance is the best strategy to safeguard your belongings and peace of mind, so get a Goodcover renters insurance quote today. And remember, if you’re switching to Goodcover from another provider, we can cancel the old policy for you.

Note: This post is for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.