Guide: Renters Insurance for College Students

5 Apr 2022 • 5 min read

As a college student, you are often on a budget, which usually means cutting every expense that isn’t absolutely necessary.

Renters insurance might seem unnecessary at first glance, but it is actually one of the most important policies to have in place. With highly affordable coverage options, renters insurance can fit most budgets, and the protection provided makes renters insurance worth your consideration as a college student.

However, your options are worth thinking through carefully, so let’s dive deeper and explore renters insurance for college students.

- Why Should a College Student Get Renters Insurance?

- What Renters Insurance Covers

- Who Renters Insurance Covers

- Common Misconceptions

- How Much Renters Insurance Do I Need?

- Final Thoughts: Renters Insurance for College Students

Why Should a College Student Get Renters Insurance?

Your college years are associated with many great memories and unique experiences — but also with being broke.

It’s understandable if you don’t opt for additional financial protection like insurance because you’re trying to save money as a first-time renter. You may not realize that renters insurance for college students can save way more money than you ever spend.

Since renters insurance is affordable and can provide tens of thousands of dollars in coverage, it’s a wise financial decision, especially if you don’t have a lot to spare.

Perils can happen to anyone, and your insurance can protect you, your stuff, and your guests.

Let’s say you’re having people over for a party after midterms and someone slips on a spilled drink, resulting in a trip to the doctor. Your renters insurance can cover that.

And if that person accidentally broke your camera for photography class on the way down, extended coverage can help you replace that, too.

What if you love your new off-campus apartment price but not so much the slightly sketchy location? Renters insurance covers your stuff in the event of a robbery or vandalism, too

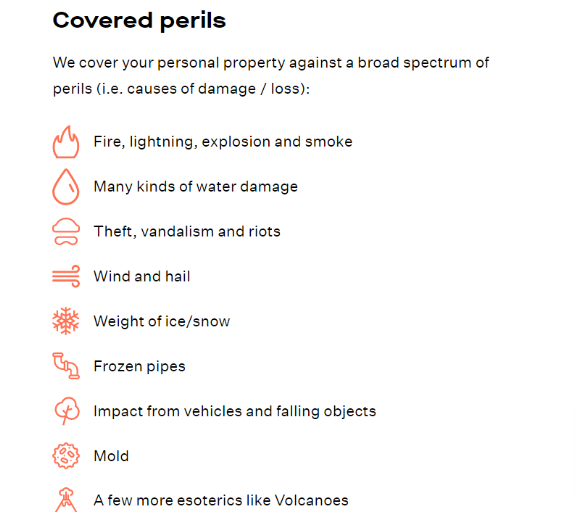

What Renters Insurance Covers

Renters insurance for college students pays for three primary things:

- Your property

- Other people and their property

- Additional living expenses

So if a fire damages your items, sends your friend to the doctor, and leaves you with nowhere to stay, your insurance company can help pay for those situations after your deductible. Remember that these things are only covered when damaged or lost due to a covered peril.

There are exclusions to the coverage, such as what's typically covered through auto insurance, earthquakes, or floods.

Goodcover's policies cover your stuff inside and outside the home but won't cover accidental damage with our GOOD plan. Upgrade to SUPERGOOD coverage to ensure that we'll replace your stuff if it gets accidentally damaged.Who Renters Insurance Covers

The SUPERGOOD plan provides zero-deductible extended coverage for eligible categories like computers and other electronics.

For example, if your post-midterm party goes awry and someone accidentally smashes your guitar, SUPERGOOD will cover it if you’ve opted for it in the musical instruments category. SUPERGOOD also kicks in if you drop coffee onto your passed-down family watch by mistake if you’ve selected it for the jewelry and wearables category.

That said, SUPERGOOD will only pay up to $3,000 for instruments, $20,000 for jewelry and wearables, and $1,000 for cameras, depending on the coverage you choose. And you’ll need evidence of your item’s value to file a claim.

Who Renters Insurance Covers

Renters insurance covers you and your belongings. And if you’d like to get a cheaper rate, you can split the costs of coverage with roommates ensuring all of your belongings are covered.

We encourage Goodcover members to share plans as it's a win-win. Everyone gets covered for a cheaper rate as long as all of the names on the plan are on the lease. Plus, if your roommates have filed claims before, it won’t impact your deductible negatively. Just a quick note: if you're sharing a dorm room, it's best to have separate policies.

The only other entity your renters insurance policy might cover damages your pet causes. It’s also important to note that renters insurance does not cover injury to your pet itself. For pet injuries, look into pet insurance.

Common Misconceptions

Here are a few of the most common misunderstandings we see when it comes to renters insurance for college students:

Renters Insurance is Expensive

Not true! Goodcover plans are highly affordable, especially if you don't have much personal property. Plus, remember you can also split the cost with your roommates!

My Stuff Isn’t Worth Enough to Insure

If it was worth buying, it’s worth insuring! Even if you think you don’t have a lot of stuff, what you have adds up fast. Counting just what you might have in your bedroom:

Just those four things add up to $2,414. Even if you got most of your electronics and furniture at a discount or second-hand, it’s important to note that Goodcover pays you for their replacement value, so you get the current retail price for a new replacement.

That’s My Landlord’s Responsibility

If your landlord has property insurance, it won’t cover your belongings or the safety of your guests. In some instances, you’ll still be held financially responsible for damage to their property.

So it’s essential to have renters insurance to cover all your bases.

I Don’t Need Insurance Because My Parents Have It

If you aren't living in the same place as your parents, you may be covered if you're staying in on-campus housing in a dorm room, returning each break. In this case, insurance would count you as a dependent. However, your parents' homeowners or renters insurance doesn't cover you in most other cases.

How Much Renters Insurance Do I Need?

In some cases, your landlord will require you to have a minimum personal liability coverage limit — usually around $100,000.

To determine how much personal property coverage you need, you should determine the value of all your personal belongings through a home inventory. That may take some time, but it helps determine if you have enough coverage.

Next, consider what you want insurance to cover. The standard insurance will protect your stuff and guests inside your home in the event of a covered peril, but if you want accidental damage, it's a good idea to upgrade.

For just a few extra dollars a month, you can add additional coverage that protects certain items if you accidentally damage them. That small extra expense could end up saving you a ton later on.

Final Thoughts: Renters Insurance for College Students

Although you’re often on a tight budget, renters insurance for college students is still vital to maintain. For a small monthly fee, you can protect your things and guests and avoid a situation where you might find yourself out thousands of dollars.

Once you determine your renters policy limits, it's easy to find coverage that works for you.

Protect your finances by getting a quote for Goodcover's renters insurance today.

Note: This post is meant for informational purposes, insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Dan Di Spaltro • 27 Jun 2025 • 20 min read

Renters Insurance in Rhode Island: Costs & Coverage

Dan Di Spaltro • 26 Jun 2025 • 12 min read

Nashville Renters Insurance: A Complete Guide

Dan Di Spaltro • 25 Jun 2025 • 18 min read

Iowa Renters Insurance: Cost & Coverage Explained

Dan Di Spaltro • 24 Jun 2025 • 20 min read

Best Renters Insurance in Charlotte: Find the Right Policy

Dan Di Spaltro • 20 Jun 2025 • 15 min read