Everything You Need To Know About Renters Insurance for Roommates

9 Sep 2022 • 7 min read

At Goodcover, we allow (and encourage) Members to share their renters' insurance coverage with a roommate — as long as you’re both named on the lease.

So, if you’re one of the many renters who, after facing high inflation rates and a lack of rental inventory, are considering a roommate agreement despite living on their own for decades, you have our support.

Saving costs wherever you can is important — especially when rent prices have no intention of slowing down.

By sharing a policy, you'll save money on the bill, only have one point of contact for any claims, and have one policy to share with your landlord or property manager.

But before you get renters insurance with your roommate, it's important to understand how everything works. Who can make changes to your policy? What happens if there's a claim? Does your roommates' previous renters insurance history affect your rate?

Let's dive into it.

Here’s what we’ll cover:

- Can You Share Renters Insurance With a Roommate?

- Does Each Roommate Need Renters Insurance?

- Does Your Renters Insurance Policy Cover Your Roommate’s Stuff?

- What Does It Mean To Share a Renters Insurance Policy With Someone?

- How To Encourage Your Roomies To Share a Policy

- Final Thoughts: What You Need To Know About Renters Insurance for Roommates

Can You Share Renters Insurance With a Roommate?

Yes, it’s possible (and recommended) to share renters insurance with your roommate. As long as you’re both named on the lease, you’ll only file one claim if accidents happen. And when you share a renters policy, the premium you pay is cut in half.

But don’t just take our word for it — let's do the math. If you and your roommate split a $20 monthly premium, you’re each paying $10.

It’s a win-win scenario that ensures you get protection for a fair price. Plus, it’s easier to manage one policy than two. If you decided to buy separate policies, you’d have to manage your own individual policy, file separate claims, and pay a larger total premium (and deductible for shared property). With one policy, your workload is essentially cut in half.

Lastly, the first name on the policy is the only person authorized to request changes and remove named insurers.

Does Each Roommate Need Renters Insurance?

While each roommate can get their own renters insurance policy, it’s generally not recommended if you’re sharing property like electronics or furniture. Having separate policies could mean getting only partial reimbursement for shared items in case of a loss.

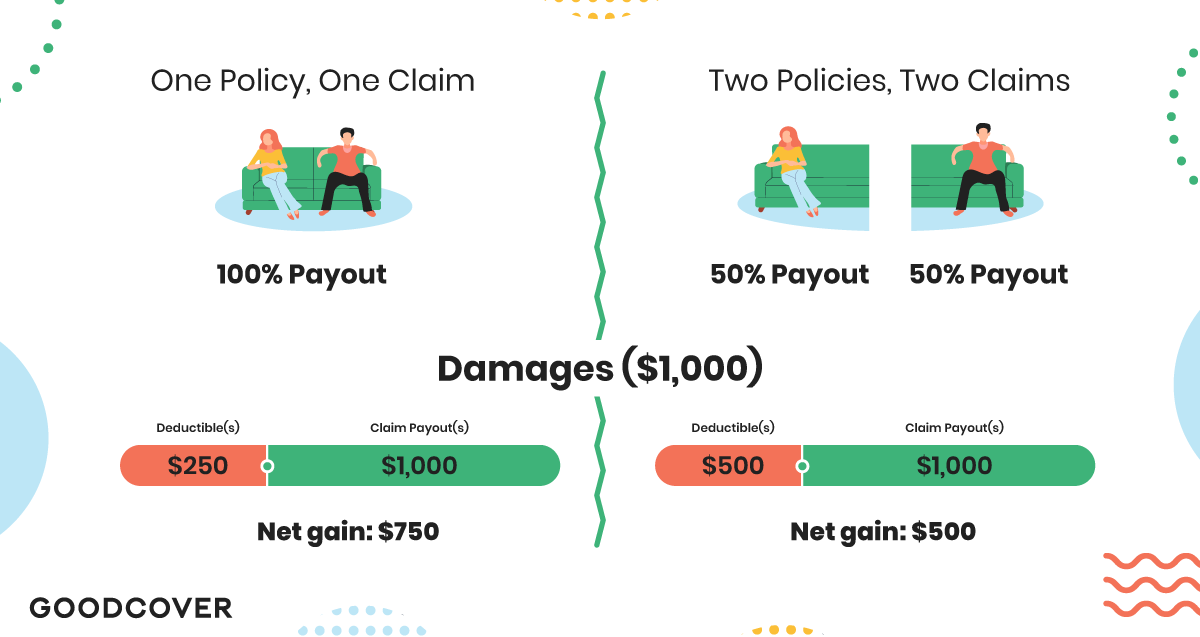

Let’s use a shared couch as an example. You both pitched in to buy a $1,000 couch for your shared living room.

If a fire breaks out and destroys the couch, each of your separate renters insurance policies would typically cover only half of the couch’s value. That’s because insurance claims payout is based only on what the insured individual owns — which, in this case, is 50% of the replacement cost value (RCV).

Instead of going through two claim processes with a payout of $500 each and twice the amount of deductibles (totaling $500), you and your roommate could file a single claim through a joint policy that nets you the couch's value ($1,000) minus a single deductible ($250).

That means a joint policy would net you $750 out of the couch’s original value, as opposed to the $500 total payout you’d get by filing two individual claims. It’s simply more time-efficient and cost-effective.

The same logic applies to events (e.g., a friend falling at your place) where both of you might be held liable. Your shared personal liability coverage would help expedite the claim and, in turn, the reimbursement.

Overall, while each roommate should be protected, it’s okay for roommates to share one policy.

Does Your Renters Insurance Policy Cover Your Roommate’s Stuff?

Goodcover renters insurance covers your personal property and a portion of shared property. It doesn’t cover your roommate’s stuff unless you’re both named on the lease, allowing you to share the policy with them.

If you’re both on the lease, the policy will also cover your and your roommate’s personal belongings inside and outside the house.

Another perk?

Your roommate’s claim history from other insurance companies won’t haunt you. At Goodcover, we believe past claims are often beyond your control, and you or your roommate shouldn’t be penalized for them. So, if you or your roommate has had a claim in the past, you can relax. Insurance history won’t raise the premium for either of you.

Should I Get Extended Coverage?

Let’s be honest, accidents happen — whether it’s a water leak ruining your fancy camera or a break-in where you lose valuable jewelry. A standard policy doesn’t cover accidental damage – you need SUPERGOOD for that.

For a small fee, you can upgrade to SUPERGOOD to ensure we replace certain classes of items with zero deductible if they get accidentally damaged as well. That means if you or your roommate spill coffee on your camera or dent your musical instrument, it's covered.

Upgrading to SUPERGOOD is simple to do when you first get a quote. Or, you can update it at any time in your Member Dashboard – just visit the Coverage page.

What Does It Mean To Share a Renters Insurance Policy With Someone?

Sharing your renters’ insurance policy can only mean two things:

- Additional interest (someone who can see the insurance policy and status).

The person will be notified if you make changes or cancel the policy. But they can't make any changes to the policy themselves. - Additional Named insured (someone who’s an additional policyholder).

At Goodcover, we keep everything simple with one named insured. Everyone else on your lease is automatically covered under your policy. While we don’t have the option to explicitly name your roommates, spouses, or significant others, you can rest easy knowing that if they’re listed on the lease, they’re covered by your policy.

If you opt for a joint policy with your roommate, only the first name insured (the person who takes out the policy) will be authorized to make changes and can receive a claims payout, but everyone is covered.

However, if a roommate vandalizes your stuff, you can’t file a claim because they’re on the policy — technically, according to the insurance policy you listed them on, it’s their stuff, too.

Lastly, if your roommate moves out, you're responsible for removing them from the insurance policy and getting a new rate, which is easy to do if you’re a Goodcover Member.

How To Encourage Your Roomies To Share a Policy

Talking about insurance doesn’t exactly make for a thrilling dinner table conversation. Not everyone’s as enthusiastic about the idea, especially when it’s about sharing a renters insurance policy.

You’ll want to be clear about what sharing a policy means for both of you:

If you’re reading this article, chances are you see the benefits and want to make it a mutual agreement.

Here are some more tips for encouraging your roomies to share a policy with you:

Assess the Relationship With Your Roommate

Firstly, how well do you know your roommate? Is this a long-time friend or someone you’ve recently connected with online?

Trust is crucial to a healthy conversation when you’re sharing financial responsibilities like insurance premiums. If they aren’t reliable with paying bills or sharing property, you might be risking your own coverage.

Create a Home Inventory Checklist

Instead of relying on your brain to keep track of your personal property (what you own) and what you share with your roommate, we recommend creating a home inventory checklist. Snap pictures or make a video of all the rooms, closet interiors, electronics, and any valuables.

Then, jot everything down onto the checklist so you have a visual representation of what you own (along with any receipts/proofs of ownership). While it might seem time-consuming, you’ll have accurate documentation of what you own, making conversations about ownership with your roommate(s) easier.

Encourage your roommate(s) to do the same. After all, any future claims you might have will start with documentation, so you’re preparing yourselves for less work down the road.

Have a Transparent Conversation

Schedules are busy, and time is precious. But setting aside a moment to talk with your roommate(s) about sharing a renters insurance policy is essential.

If you’ve already brought up the topic and been shut down, it might be a good idea to bring up data about why you should get renters insurance. You can discuss potential premiums and payouts based on different scenarios.

For instance, bring up the couch situation we mentioned earlier — splitting the premium would halve the cost, and if you share coverage, the policy will cover all of your and your roommate's belongings.

But if each of you has a policy, or worse yet, only one person has insurance coverage, there would be no cost savings, and you'd only get to file a claim for the percentage of the shared property you own.

Lastly, you should address some concerns proactively, such as what happens if one person moves out or how policy limits affect a claim payout. This is where you’d want to reference some of Goodcover’s policy details.

Final Thoughts: What You Need To Know About Renters Insurance for Roommates

Renters insurance policies for roommates are a win-win. It’s cost-effective, cutting your premiums in half — and it avoids hassle when compared to separate policies.

Goodcover Members get to enjoy one policy with specified coverage limits that protect both you and your roommate’s belongings, making claim filings easy. Plus, any past claims you might have won’t affect your current rates.

With Goodcover, you can always upgrade for additional coverage, giving you peace of mind for any scenario involving your valuables. Protect your and your roommate’s belongings by joining. Goodcover. Get a renters insurance quote today.

Note: This post is for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Team Goodcover • 19 Aug 2024 • 10 min read

Colorado Rent Increase Laws: A Comprehensive Guide for Renters

Team Goodcover • 15 Aug 2024 • 4 min read

Does Renters Insurance Cover Theft?

Team Goodcover • 1 Aug 2024 • 4 min read

Liability Coverage Explained: What Every Renter Needs to Know

Team Goodcover • 26 Jun 2024 • 8 min read

How to Get Renters Insurance

Team Goodcover • 13 Jun 2024 • 6 min read