Does Renters Insurance Cover Power Outages? Here’s What’s Included and Excluded

31 Mar 2022 • 2 min read

The Texas power grid failure of 2021 showed us how heavily our lives depend on the continuous power supply.

A short power outage can be frustrating, but a lengthy outage can result in significant losses. The Texas power system failure resulted in significant consequences, including the following:

- Food and water shortage

- Lack of heating and resultant issues

- Reduced capacity of fire fighting units

- Broken pipes and plumbing issues due to freezing

According to Texas Monthly, the 2021 power grid failure was just a warm-up, and Texas remains vulnerable to additional power outages in the future.

So, how can you protect your personal property against a power outage? Does renters insurance even cover power outages in the first place?

Keep reading to learn::

- Does Renters Insurance Cover Power Outages?

- Power Failure and Renters Insurance

- Final Thoughts: Does Renters Insurance Cover Power Outages?

Does Renters Insurance Cover Power Outages?

Let’s start with the basics: Goodcover renters insurance doesn’t kick in just because you have a power outage, but renters insurance will protect damages due to a covered loss resulting from a power outage.

Power Failure and Renters Insurance

A power outage, also called a “power failure”, a “blackout”, or a “power loss” is defined as a failure of power that takes place off the residence premises.”

This definition means that to be eligible for personal property coverage, a power outage must occur outside of your rental unit.

In the event of a power outage, you could be compensated in two scenarios:

Power Failure Results in a Covered Peril

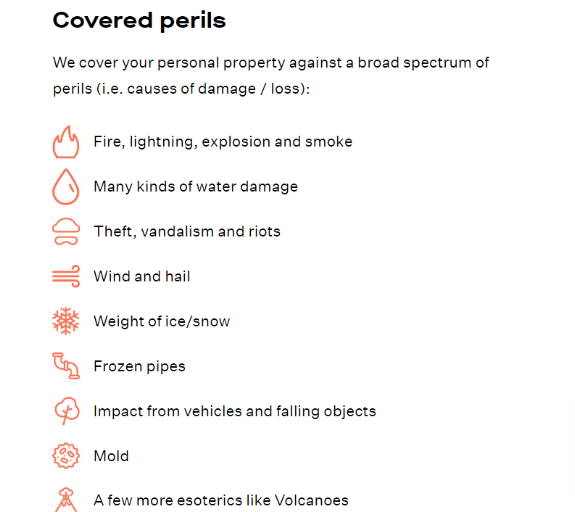

Goodcover rental insurance policy insures you against a broad spectrum of events that might cause damage or loss to your personal property. In the insurance world, these are called covered perils.

Here’s what Goodcover defines as a covered peril:

So, if the power outage causes a peril from the chart above, like a fire that damages your belongings, your Goodcover renters insurance plan will likely kick in cover the damage.

Other examples of perils that might occur due to a power failure are:

- Water damage due to frozen pipes

- Smoke and fire hazards

- Injury or property damage due to falling power lines

- Vandalism occurring due to power outage

Final Thoughts: Does Renters Insurance Cover Power Outages?

A power failure can trigger for various reasons — from a natural disaster, like a windstorm, to an equipment malfunction. Power outages can result in additional problems and cause damage to your personal belongings.

Your renters insurance will help you insure your valuables against the losses due to a power outage. While Goodcover’s renters insurance doesn't cover power outage losses directly, you can still get coverage for losses due to covered perils occurring from power failures.

Take the first step to insure your personal property. Get a renters insurance quote from Goodcover today.

Note: This post is meant for informational purposes, insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Team Goodcover • 26 Jul 2024 • 6 min read

Colorado Renters Insurance: What You Need to Know

Team Goodcover • 19 Jul 2024 • 6 min read

Goodcover’s Guide to Ohio Rent Increase Laws: Know Your Rights as a Renter

Team Goodcover • 6 Jul 2024 • 6 min read

6 Renters Insurance Mistakes (and How to Protect Yourself)

Team Goodcover • 26 Jun 2024 • 8 min read

How to Get Renters Insurance

Team Goodcover • 7 Jun 2024 • 3 min read