6 Solid Reasons To Get Renters Insurance From Goodcover

9 Sep 2022 • 6 min read

Would you be able to replace all your electronics and furniture if your apartment caught fire? What about your appliances, clothes, and laptop?

If the answer is no, you most likely need a renters insurance policy.

Renters insurance can't prevent terrible things from happening, but it can make your life a little easier if and when they do.

With that in mind, here’s what we’ll cover:

- Why Do You Need Renters Insurance?

- 1. Renters Insurance Is Affordable

- 2. Renters Insurance Covers More Than Just Your Personal Property

- 3. Renters Insurance Protects Your Stuff Inside and Outside Your Home

- 4. Climate Change Is Real, and It Affects Tenants

- 5. Your Landlord Probably Requires It

- 6. Your Peace of Mind Is Valuable

- Final Thoughts: 6 Solid Reasons Why You Need To Get Renters Insurance

Why Do You Need Renters Insurance?

Renters insurance can help policyholders replace their belongings after damages caused by many types of covered perils. A covered peril is a risk or cause of loss. These might include fire, water damage, theft, or vandalism.

A renters insurance coverage can also provide personal liability coverage for an accident at your home involving your guests. Or if you get sued for bodily injury or accidental property damage.

Here are six more reasons why you need to get renters insurance:

1. Renters Insurance Is Affordable

One common reason people avoid renters insurance is the cost involved since many people are looking to save money these days. Or, they think they don’t own a lot of stuff and assume it’s easier to replace damaged or lost items than pay a monthly insurance fee.

But for most of us, our furniture, clothes, and electronics are worth thousands of dollars. Replacing it all would be no easy task.

For example, suppose a fire in your apartment causes significant damage to your personal belongings, and you incur losses worth $10,000. Would you rather pay a $500 deductible to replace your stuff or cover the $10,000 yourself? If something like that happens, you’ll be glad you paid for the coverage.

Renters insurance is one of the most affordable types of insurance. It’s cheap enough to insure your valuable belongings and prevent significant financial strain on your side.

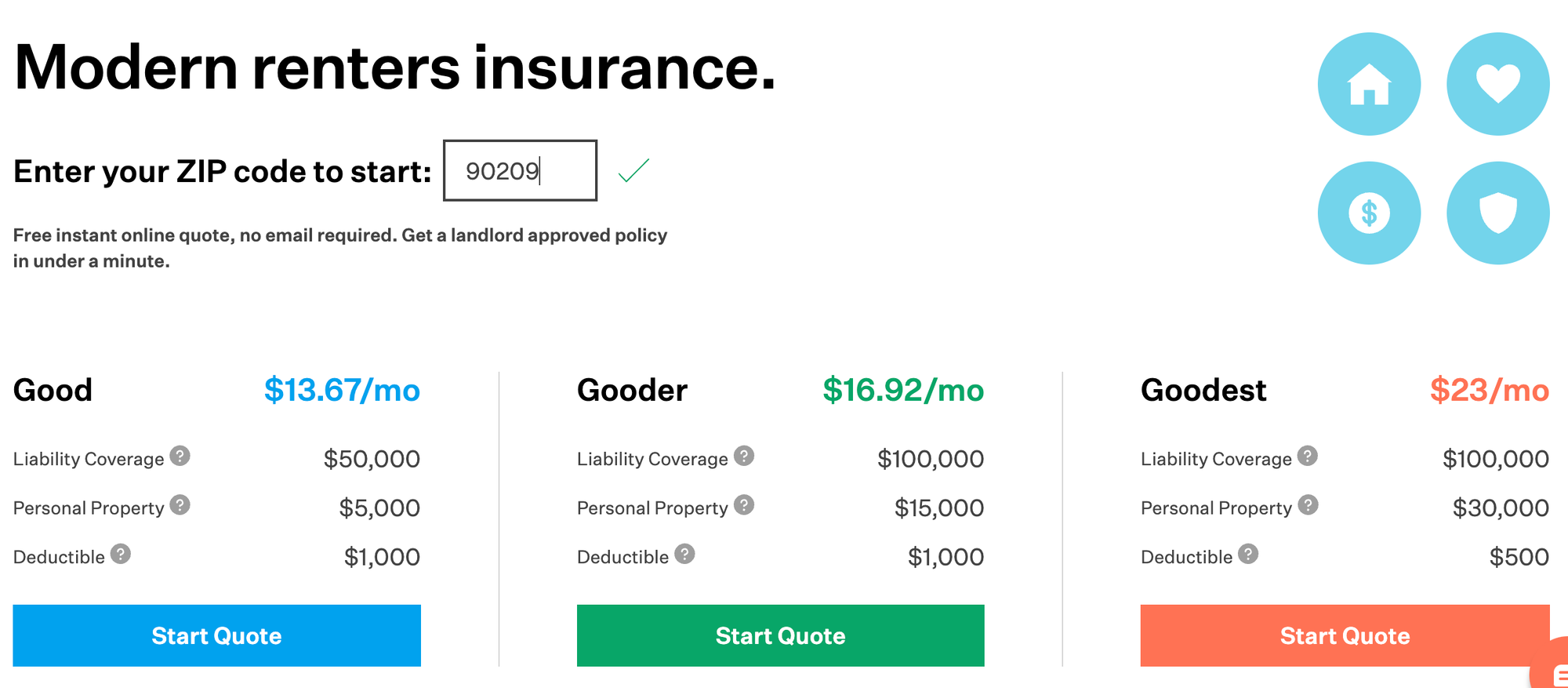

That said, the actual replacement cost will depend on the amount of coverage you need, your deductible amount, the type of coverage you select, and where you live.

For example, if you live in California and your zip code is 90209, your renters insurance cost will start at $13.67 per month.

2. Renters Insurance Covers More Than Just Your Personal Property

People incorrectly assume that renters insurance just covers their personal property, but that’s not accurate.

Let’s say a flood or leak causes damage to your neighbor’s apartment. Or, your dog bites someone at the park. If you're sued, your renters liability coverage will typically cover costs up to your coverage limit — even if the incident happened away from home.

Renters insurance also covers you when you can’t live comfortably in your rental property because of a covered peril — it’s called loss of use or temporary housing.

For example, suppose a kitchen fire razes down part of your house, forcing you to live somewhere else temporarily. In that case, renters insurance will cover your additional living expenses.

It'll cover expenses such as hotel stays and restaurant meals while you wait for your apartment repairs. However, there’ll most likely be spending limits per night, week, or month, so don't expect to stay in a five-star hotel.

We bundle temporary housing coverage with property coverage since it’s often overlooked but extremely helpful.

3. Renters Insurance Protects Your Stuff Inside and Outside Your Home

Renter's insurance covers your personal property, whether in your home, car, or when traveling. Your belongings are protected from theft and other covered losses anywhere in the world.

For example, if someone steals your camera while you are touring the Taj Mahal in India, your renters insurance company will pay to replace it. But keep in mind that it makes sense to file a claim only if the lost item is worth more than your deductible.

For instance, suppose your stolen phone is worth $300, and your deductible is $500. In that case, there’ll be no need to file a claim since the cost of replacing the phone would be less than the deductible you’ll pay for the insurance company to replace it.

Another example would be if someone breaks into your car and steals your belongings. Your auto insurance won’t cover what’s inside the vehicle — that falls to renters insurance (if you have it).

Renters insurance will also cover you when you have to keep your stuff in a storage unit, up to a certain sub-limit (as listed on your policy). Property such as furniture, clothing, electronics, and appliances will all be covered should fire or water leaks damage them.

Even if a thief manages to steal some stuff from the unit, your renters insurance will cover the cost of replacing them.

4. Climate Change Is Real, and It Affects Tenants

Natural disasters can strike at any moment and with little warning. And if you've worked hard to pay off debt and save for an emergency, or you’re saving for a down payment on a house, the last thing you need is a disaster wiping out everything you have.

Droughts lead to more fires, and severe storms can lead to leaks and power grid failures. For example, Texas experienced a major power outage in February 2021 due to three severe winter storms that swept across the U.S. More than 4.5 million businesses and homes had no power for several days.

The best time to prepare for a disaster is before it happens. Being proactive is crucial, and insuring your personal property with a renters insurance policy will help you be ready if any disaster strikes.

5. Your Landlord Probably Requires It

Some people don't purchase renters insurance because they think their landlord’s policy covers them. That isn't true.

The landlord's insurance covers the building structure and the grounds, but not your personal property. For example, if someone steals your laptop or a fire destroys your kitchen equipment, your landlord’s insurance won’t cover the cost of replacing them — but a renters insurance typically will.

The landlord’s insurance is also unlikely to help if you accidentally damage a neighboring apartment. For instance, if you let your bathtub flood the apartment below you, the landlord won't cover that. Your neighbor or landlord can sue you for damaging the apartment below you.

In that case, you'll need renters insurance to cover damages, medical bills, or legal fees for injuring or damaging someone else's property by accident.

Many landlords now require tenants to buy their own renter's insurance policies. They'll want to be listed as an additional interest to see your liability limits and confirm you have an active insurance policy.

They're unconcerned about your personal property coverage because it doesn't affect them. Landlords simply want to ensure that your insurer will cover their property if you damage it.

6. Your Peace of Mind Is Valuable

If everything in your house is disposable and you don’t care about replacing them, you can probably skip renters insurance. But if something were to happen and you can’t afford to replace everything you own immediately with money from your savings account, you need a renters insurance policy.

Almost everyone nowadays owns expensive electronics and other valuables. Have you ever calculated how much it would cost if you suddenly had to replace everything you own?

After calculating that surprising figure, consider how much renters insurance premium you can pay each month to get the peace of mind you deserve as a renter.

If your belongings are destroyed or damaged, having renters insurance can mean the difference between quickly landing on your feet or dealing with stress.

You probably won’t even need to use the renters insurance coverage. But if you ever need to, you can avoid a shame spiral by having safeguards. And the peace of mind you’ll feel is worth the money invested.

Final Thoughts: 6 Solid Reasons Why You Need To Get Renters Insurance

After working so hard to acquire your stuff, don't let it all disappear overnight. The cost of replacing it all could prevent you from hitting your financial goals.

Renters insurance will protect you against potentially devastating financial consequences. Get a Goodcover renters insurance quote today.

Note: This post is for informational purposes; insurance regulation and coverage specifics vary by location and person. Check your policy for exact coverage information.

For additional questions, reach out to us – we’re happy to help.

More stories

Dan Di Spaltro • 11 Jul 2025 • 19 min read

Cheapest Renters Insurance in NJ: A Guide to Affordable Coverage

Team Goodcover • 26 Jun 2024 • 8 min read

How to Get Renters Insurance

Team Goodcover • 17 May 2024 • 3 min read

Renters Insurance Facts: Debunking Common Myths

Team Goodcover • 9 Feb 2024 • 5 min read

Does Renters Insurance Cover Personal Property Damage Caused by Police?

Team Goodcover • 12 Jan 2024 • 5 min read